UK-based private credit investment manager Shard Credit Partners (“SCRP”), through its wholly-owned subsidiary SCRP Trade Finance Ltd, has expanded internationally with the recent launch of its new business in the United Arab Emirates (“UAE”). This strategic expansion marks a significant milestone in the build out of the company’s International Trade Finance strategy and further enhances its offering to businesses in the Middle East and worldwide.

SCRP launched its International Trade Finance strategy in 2022 and already serves a diversified base of SMEs customers throughout the UK and UAE.

The new UAE office will serve as a hub for SCRP Trade Finance operations in the region, offering trade finance solutions to meet the diverse needs of businesses engaged in both domestic and cross-border trade. With experienced professionals on the ground and a deep understanding of the local market dynamics, SCRP Trade Finance aims to provide seamless and efficient financial support to businesses seeking to grow their trading revenues.

“We are delighted to establish our presence in Dubai, a vibrant economic hub with immense potential for growth and development. By opening this office, we reaffirm our commitment to empowering emerging corporates and SME businesses in the Middle East and beyond with trade finance solutions that drive expansion, foster economic prosperity, and facilitate global trade” said Moiz Akbar, SCRP’s Dubai based Partner in the International Trade Finance strategy.

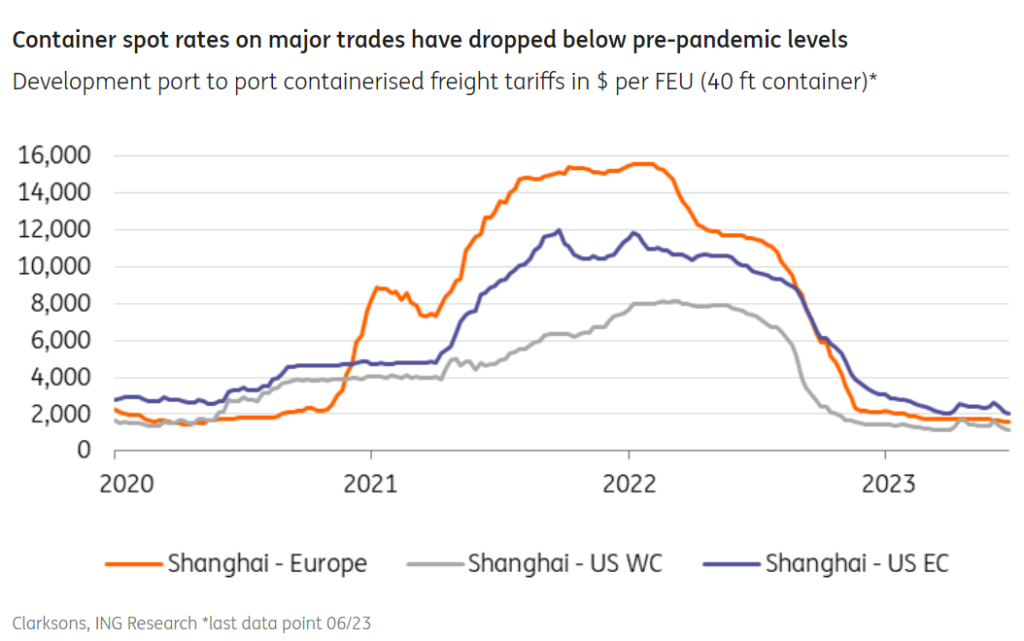

Chris Ash, Head of International Trade Finance at SCRP Trade Finance, added “as the world economy emerges from the aftershocks of the Covid 19 pandemic, the availability of working capital solutions has become more challenging, especially for the mid and lower mid-market trading communities. Our expansion into this vital trading hub will improve local access for businesses that require incremental financial support.”

SCRP Trade Finance is committed to providing transactional capital to address the capital needs of businesses engaged in cross-border trade; structuring trade finance transactions to optimise financial efficiency and mitigate risks effectively.

Alastair Brown, CEO of Shard Credit Partners Ltd commented,

“Our International Trade Finance strategy offers seasoned private credit investors an interesting alternative to traditional direct lending, with the opportunity for higher cash yields in the high teens and shorter commitment durations of just two to three years. As the underlying trades are self-liquidating, this facilitates rapid recycling of investor capital and return realisation. Investors also have a broader range of investment channels to choose from with this strategy, including investing by purchasing fixed and variable coupon notes issued by a Luxembourg securitisation vehicle, with dedicated investor compartments and an ISIN if desired.”

The opening of the UAE office underscores SCRP’s commitment to structuring innovative financing solutions for its SME clients, fostering long-term partnerships and facilitating business expansion and cross border trade. Having already extended trade finance facilities to existing GCC clients, this expansion will not only deepen ties with current relationships but also underscores SCRP’s confidence in the region for growth and collaboration.