NEWS & MEDIA

Trade Finance, an asset class to help you navigate today’s choppy seas

8 March 2024

Container Ship passing through the Suez Canal

Approximately 12% of global trade , valued at over $1 trillion, passes through the Suez Canal. In the case of Europe/Asia specific trades, this figure rises to 40%. The canal has long been a vital artery for world trade, saving significant time and distance, particularly for goods traveling between East Asia and Western Europe. According to Egypt’s Suez Canal Authority (“SCA”), the waterway hosts 50 vessels a day, carrying between $3 to 9 billion worth of cargo combined. 28% of these vessels are large container ships carrying up to 20,000 containers each.

The importance of the Suez Canal was highlighted in 2021 when the Ever Given blocked the canal for six days causing extensive delays for over 400 vessels and necessitating lengthy detours around the Cape for many others. Presently, due to ongoing geopolitical events in the West Bank and retaliatory actions by Yemen’s Houthi rebels, delays of up to four weeks are being experienced, leading to significant increase in container rates for vessels that would typically transit the canal. Shipping lines are compelled to opt for the longer route around the Cape of Good Hope.

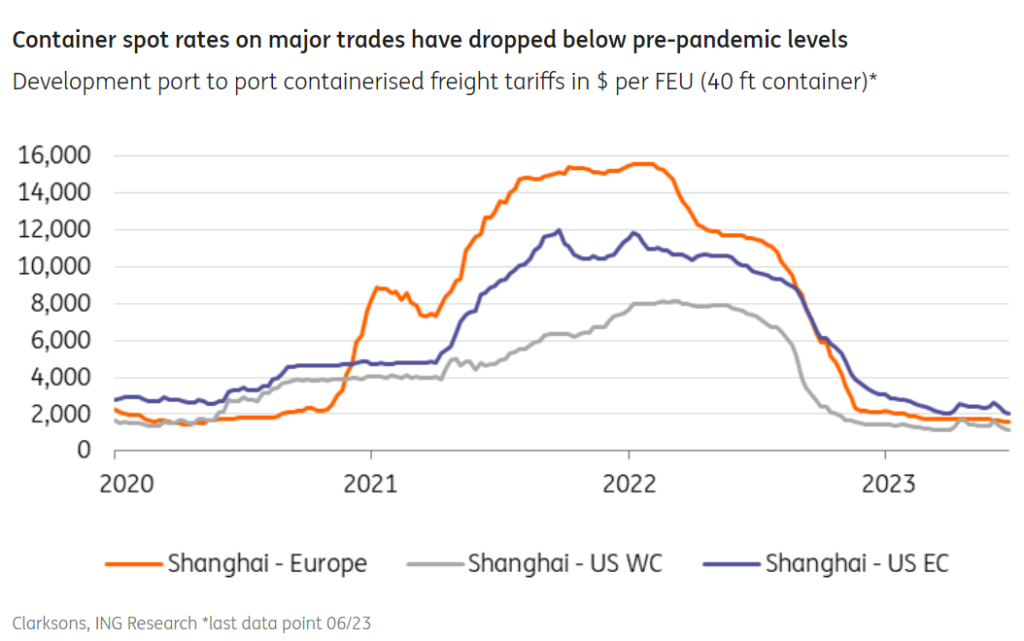

Fortunately, the shipping industry’s significant overcapacity following the Covid-19 pandemic has helped alleviate the current situation to some extent. However, prolonged tensions in Gaza could result in potential shortages, particularly for consumer goods reliant on shorter transit times. Whilst the timing of the Chinese New Year has mitigated some impact, a shortage of empty shipping containers, which caused a sharp increase in freight rates during the pandemic, has yet to materialise. Nonetheless, the rapid rise in container rates is likely to exert inflationary pressure on goods prices if the situation persists.

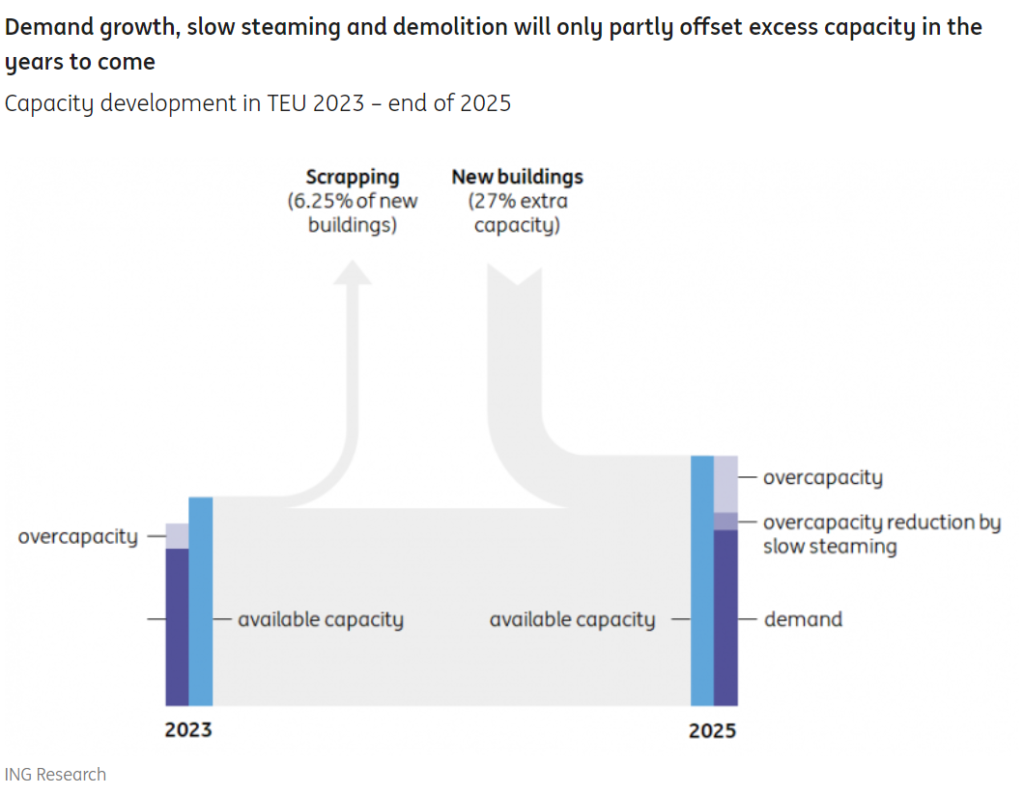

Goods with lower profit margins, dependent on competitive container prices, are particularly susceptible to short term price fluctuations. Despite these challenges, traders have become more resilient in the post-pandemic era. The long-term outlook for shipping is that over-capacity will remain a significant factor through 2024 and 2025 in dictating normalised shipping rates, whilst economies around the world make the slow climb out of recession. ING Research sights 27% of additional capacity coming on stream during this period, whilst scrapping is running at only 6.25% of new vessels. Over-capacity has recently been mitigated by “slow-steaming”, the process of operating a container ship significantly under their maximum speed. However, there is considerable availability nonetheless. The current spike in container rates being experienced is wholly event driven and an extreme dislocation of the base trends. The current increase in rates is wholly disproportionate to the actual economic cost of elongated transit times, and as the Pandemic experience demonstrated, rates crashed down very quickly, falling by as much as 90% from their Covid-19 peak.

At Shard Credit Partners (“SCRP”) Trade Finance, we stand by our clients during these challenging times, offering extended tenors on trades adversely affected by current events. Only a handful of trades were impacted. Our trading lines of credit are designed for flexibility, allowing us and our clients to adapt swiftly to changing circumstances and mitigate risks before shipment. The container rates on our trades are set before SCRP engages in a transaction, so if the economics of the trade do not stack up, the Trade Finance team do not enter into the transaction. Furthermore, we ensure goods are insured for 110% of their value against piracy or loss, and regular interaction with counterparties helps manage risks for all stakeholders involved in the trades we finance.

Through SCRP’s robust and flexible investment approach, we:

- Generate market leading risk adjusted returns which are not correlated to world events

- Deliver a diversified and dynamic portfolio of trades across jurisdiction, tenor and sector

- Offer downside protection by being extremely adaptive to micro and macro-economic factors due to the short tenor and nature of transactions, and the uncommitted nature of the facilities offered

- Share our deep knowledge and insights on one of the oldest forms of finance

Chris Ash Head of Trade Finance comments:

“SCRP’s dynamic Trade Finance Offering is well placed to meet the ever-changing landscape that our clients face. We pride ourselves in being able to support and advise businesses on trading securely, regardless of the challenges which may be encountered. Trade always finds a way despite headwinds, and following the pandemic, is more robust than ever before. The short term nature of trade finance makes the asset class extremely responsive to world events, and offers a very secure investment opportunity when compared to other forms of finance.”

About Shard Credit Partners:

Shard Credit Partners (SCRP) is an alternative investment fund manager focused on high cash yielding private credit strategies in the UK lower mid-market. Its funds seek to generate superior risk-adjusted returns from conservatively structured senior secured credit investments with meaningful equity upside. Fund strategies include corporate direct lending, technology venture financing and international trade finance.

SCRP is currently fundraising for its International Trade Finance strategy and is initially seeking to raise US$100 million from a mixture of institutional private credit investors, including local government pension funds, corporate pension funds, endowments, family offices and high net worth individuals classifying as sophisticated professional investors.

SCRP have established a securitisation vehicle structure in Luxembourg which provides access to this strategy through the purchase of three or five year fixed income notes that will pay regular quarterly cash distributions derived from a diversified pool of short-term trade finance instruments. Investors further have the option of purchasing notes with an ISIN and or credit enhancement features including an investment grade credit wrapper from a reputable credit insurance provider. Investment portfolios tailored to meet the specific preferences and appetite of investors are available.

Shard Credit Partners Ltd is an Appointed Representative of Shard Capital AIFM LLP, authorised and regulated by the FCA (FRN 615463).

| Contact details: | Investor relations: IR@shardcreditpartners.com

Business: info@shardcreditpartners.com Website: www.shardcreditpartners.com |

NEXT STORY