NEWS & MEDIA

Shard Credit Partners provides financing in support of the acquisition of GenGame Ltd by Chameleon Technology (UK) Ltd.

18 November 2021

Shard Credit Partners has provided financing to portfolio company Chameleon Technology (UK) Ltd (“Chameleon Technology”) to facilitate the acquisition of GenGame Ltd (“GenGame”).

Chameleon Technology, based in Harrogate, North Yorkshire, is a market leader in smart energy technologies. Chameleon Technology’s seven million installed In-Home-Displays (“IHDs”) help millions of customers nationwide to understand and manage their energy consumption, allowing consumers to make increasingly economic and sustainable energy decisions. The acquisition of GenGame enhances Chameleon Technology’s capability to deliver value to consumers through real-time energy data and personalised insights, as the nation transitions to achieving net zero greenhouse gas emissions by 2050.

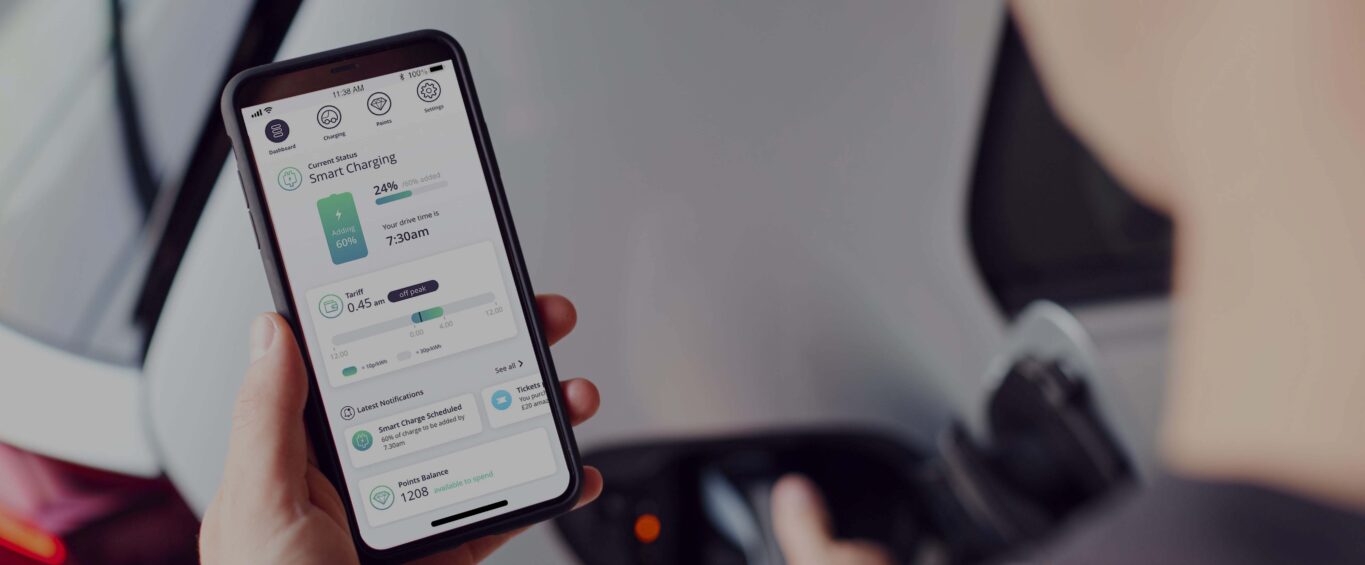

GenGame is an energy technology company based in Leicester, with an app product suite and data platform that integrates with smart meters, electric vehicles, billing systems and heating systems to provide households with a concise view of their energy consumption and payments. This empowers individuals to make changes to reduce their carbon footprint and to reduce their energy costs. Gengame’s technology helps utilities to engage with and create value with customers.

The acquisition will provide enhanced capabilities to the core group, predominantly accelerating the development of Chameleon Technology’s direct to consumer products. GenGame will become a wholly owned subsidiary of Chameleon Technology but will continue to operate out of Leicester. The current Managing Director of GenGame, Stephane Lee-Favier will continue to fulfil this role for GenGame as well as joining the Operations Board at Chameleon Technology to provide strategic input into future technology developments.

The acquisition was funded by Shard Credit Partners under an incremental facility provided as part of an existing £12.5 million senior secured unitranche facility provided in support of the primary Management Buy-Out (“MBO”) of Chameleon Technology in December 2020.

Mike Woodhall, CEO, Chameleon Technology, says: “Acquiring GenGame is a timely strategic move to further advance our product roadmap. Our focus is on enabling all consumers to understand and reduce both their energy consumption and carbon emissions. With this acquisition we gain another means of empowering those consumers and the ability to put the data needed to help them on their personal journey to net zero in their hands.

We are aiming to make the management of home energy smarter, simpler, greener and more personalised. GenGame’s experience in delivering applications that demystify some of the complexity of the energy system is going to be a big part of this. The acquisition is well-timed to leverage and support the transformation of the energy industry and will cement our position as a leader in smart home energy management.”

Stephane Lee-Favier, Managing Director, GenGame Ltd, says: “It is great to be joining the Chameleon Technology group, and at a very exciting time for the future of energy. We are looking forward to scaling and commercialising what we have built and driving a consumer-led, low-carbon offering together. Both of our companies’ missions are totally aligned in allowing the consumer to see value in changing their home energy behaviour, and this makes it an ideal opportunity for GenGame.”

Alastair Brown, CEO of Shard Credit Partners commented: “We are delighted to have this opportunity to further support the growth and development of Chameleon Technology in its acquisition of GenGame. The combination of the two businesses will accelerate the combined group’s effort to help the UK achieve net zero in line with the UK Government’s objectives in the coming years.”

Legal advice and due diligence surrounding the acquisition was provided to Chameleon Technology by Clarion, led by Hitesh Taylor.

Tax and structuring advice to Chameleon Technology was provided by Ryecroft Glenton, led by Simon Whiteside.

Legal advice to GenGame Ltd was provided by Austin Moore & Partners, led by Louise Firth.

Legal advice to Shard Credit Partners was provided by Andrew Madden and Carys Hughes-Jones of Gateley Legal.

Shard Credit Partners’ strategy is to become a leading provider of capital to entrepreneur and management-owned companies, VC backed growth businesses and private equity-owned companies focused on achieving transformational growth and expansion in the UK regions. During the past four years, Shard Credit Partners has invested more than £130.0 million in supporting regional Management Buy-Out transactions and M&A buy-and-build acquisition strategies, as well as growth capital expenditure financing.

About Shard Credit Partners:

Shard Credit Partners ltd (an Appointed Representative of Shard Capital AIFM LLP, authorised and regulated by the FCA – number 615463) is an alternative investment fund manager focused on private credit strategies in the UK lower mid-market. Its funds seek to generate superior risk-adjusted returns from conservatively structured senior secured credit investments with equity upside. Fund strategies include direct lending and tech-focused venture debt.

Shard Credit Partners is currently investing from its debut direct lending fund Shard Credit Partners Fund I, which held a first close in October 2017 at £90.2 million. Shard Credit Partners plans to hold a first close on its second UK lower mid-market direct lending fund during Q1 2022.

Shard Credit Partners invests in solid small to medium sized businesses with strong management teams, supporting them by providing transformative growth capital and event driven financing in support of innovation, growth, and expansion. The Fund invests in businesses across all sectors and throughout the UK.

The firm has a robust ESG focus; in particular, it is a strong supporter of female entrepreneurs and firms with meaningful female leadership, ownership, and senior management.

Recent investments include the venture debt financing for Rezatec Limited in August 2021, the refinancing and shareholder reorganisation of Midwest Mechanical and Electrical Services Ltd in August 2021, the venture debt refinancing of PassFort Limited in May 2021, as well as the financing in support of the acquisition of The Technology Group by Gradwell Communications in March 2021. The Fund completed financing transactions for the MBI of JST Services Ltd in Scotland, the MBO and buy-and-build strategy of eQuality Solutions Ltd in the North-East of England, and the MBO of Chameleon Technology (UK) Ltd in Harrogate, North Yorkshire, each of which completed in December 2020.

In 2020, Shard Credit Partners ranked eighth in the Debtwire UK Direct Lender league table published by Acuris. Shard Credit Partners was recently awarded Alternative Finance Provider of the Year 2020 (North-East region) in the Insider Dealmakers Awards.

Contact details:

| SEC Newgate

|

Tel: Elisabeth Cowell / Robin Tozer / Isabelle Smurfit |

| Shard Credit Partners | Investor relations: IR@shardcreditpartners.com

Business: info@shardcreditpartners.com Website: www.shardcreditpartners.com |

NEXT STORY